ATTENTION: Business owners & Incorporated Professionals

You’ve built your business and wealth—now let's keep more of it and extract tax efficiently.

Whether you've got a large sum of retained earnings, or you want to reduce your tax liability from capital gains - I've got a tailored solution vetted by 25+ years of experience!

Fill in a simple form and get access to a limited-time, FREE consultation, FREE planning guide, & Introductory video to uncover how to protect your legacy, optimize retained earnings, and pay yourself smarter.

Here's What My Clients Have Said:

Fill in the form to claim your free stuff, or keep scrolling for more information!

Discover the Advanced Strategies Vancouver Business Owners Use to Keep More of Their Wealth

View our privacy policy & terms & conditions

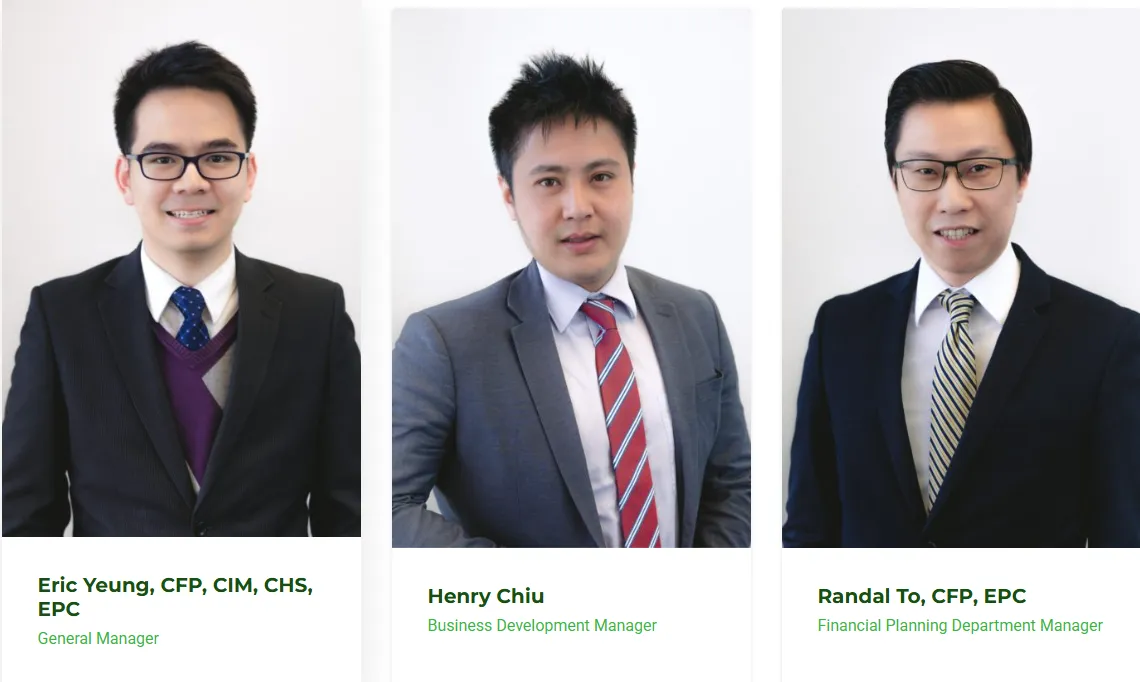

With 25+ years of experience, we specialize in wealth preservation and tax optimization for business owners and professionals.

What makes us different:

- No cookie-cutter plans—only custom strategies designed for your situation.

- Deep expertise in Health Spending Account planning, tax free dividend (CDA) planning, RRSP meltdown strategies, retirement planning, estate planning and capital gains tax minimization.

- Local Richmond, BC presence with bilingual English & Chinese service for full clarity and cultural understanding.

We're not a sales team, we want to make sure you're a good fit first.

By claiming your FREE guide, you'll learn how to:

Utilize corporate pre-tax dollars for eligible personal health care expense.

Extract tax-free dividends with the Capital Dividend Account.

Protect your estate and slash probate, legal, and executor fees.

Use RRSP Meltdown strategies to dramatically reduce retirement taxes.

Limit capital gains tax on business or property sales, with capital gains tax planning.

Utilize corporate retained earnings to tax efficiently provide cash flow for

personal retirement

What's the Main Focus in Your Business Right Now?

Are You Overpaying the CRA?

Business owners often pay tens of thousands more in taxes than they need to. With advanced tax planning strategies like Health Spending Accounts (HSAs) and Capital Dividend Accounts (CDAs), you can put more money back into your pocket.

Is Your Wealth Really Protected?

Without proper estate planning and shareholder agreements, your family could lose hundreds of thousands to probate, legal fees, or forced asset sales. We’ll show you how to protect your legacy and your corporation’s retained earnings.

What’s Your Business Succession Plan?

70% of business owners don’t have a succession plan, yet capital gains tax on exit can wipe out decades of growth. Learn how to pass on your wealth tax-efficiently and retire with confidence.

Here's the Problem

Right now, 76% of business owners plan to exit their business within the next 10 years, often representing over $2 trillion in transfer value just in Canada. And yet, only 9% have a formal, documented succession plan in place.

Meanwhile, in British Columbia, probate fees can cost you 1.4% of your estate, without a cap—meaning a $1 million estate could face over $14,000 in fees before your heirs even see a dollar.

How I'll Help:

Strategically extract wealth using tax-smart structures like Principle protected segregated funds and insurance related products to by pass probate and obtain CDA credit for tax free dividends.

Avoid probate and estate administration fees through techniques like insurance related products along with trust planning.

Future-proof your business succession with plans that ensure a smooth transition—whether to family, employees, or external buyers.

Reduce retirement tax stress, including strategies like the RRSP Meltdown and corporate insured retirement concepts to supplement your retirement.

Book your free, no-obligation strategy session today—so you can take confident steps toward protecting your legacy, reducing taxes, and securing your family’s future.

Frequently Asked Questions

What makes Plantax Pacific Financial different from other advisors?

Most firms focus on investment products alone. At Plantax, we specialize in advanced tax planning and succession strategies for business owners and professionals—helping you keep more of what you’ve built and prepare for a smooth transfer of wealth.

Why should I worry about succession or exit planning now?

Because timing matters. 76% of business owners plan to exit within 10 years, but only 9% have a formal plan. Without one, you could face higher taxes, legal delays, and unnecessary costs that reduce what your family or successors receive.

I already have an accountant, do I still need you?

Yes—our work complements your accountant’s role. While accountants focus on reporting and compliance, we specialize in strategic planning to reduce taxes, minimize probate fees, and structure your succession plan in advance.

How does the free guide and video help me?

They uncover what the CRA won’t tell you—strategies like using a Capital Dividend Account, avoiding double taxation on death, and minimizing probate fees in BC. These insights give you a roadmap to discuss further in your free consultation.

What happens after I download the guide?

You’ll be directed to a short introductory video where I explain these strategies in detail. From there, you can book a free strategy call with me to apply these insights to your specific situation.

Is there a cost or obligation to work with you?

No—your initial consultation is completely free and confidential. It’s simply an opportunity to see if advanced planning could save you significant money in taxes and estate costs.

Do you work with both English and Chinese speaking clients?

Yes. I am fluent in both English and Mandarin Chinese, ensuring you can fully understand and feel confident in the planning process.

How do I know if I qualify for these services?

We typically work with business owners, incorporated professionals, and families. If you’re building wealth and want to protect more of it, you’ll benefit from our approach.

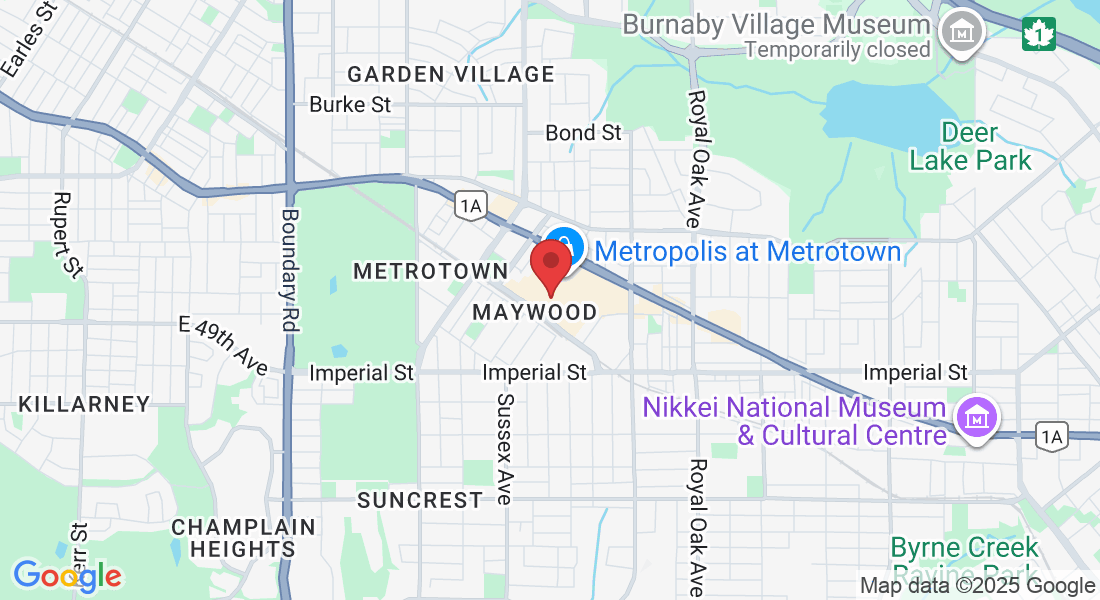

Here's Where You Can Find/Contact US

Give us a call, send us an email, or visit our office!

Phone: +1 (604) 726-5822

Email: [email protected]

Address: 2401-4710 Kingsway, Burnaby BC, V5H 4W4 Metrotower 1

Copyright 2025 | Plantax Pacific Financial